Demystifying

FBR's Latest Tax Changes:

A Comprehensive Guide to Cash Withdrawal Tax

In a significant step aimed at boosting tax

revenues, the Federal Board of Revenue (FBR) has made an important announcement

regarding tax collection on cash withdrawals from individuals who are not

listed in the Active Taxpayer List (ATL) by banks.

According to Circular No. 2 of Income Tax, dated

July 26, 2023, the Finance Act, 2023 has introduced changes to the Income Tax

Ordinance, 2001. The newly added Section 231AB of the Income Tax Ordinance,

2001 now requires every banking company to deduct an advance adjustable tax of

0.6% from any individual who is not listed in the ATL at the time of making

cash withdrawals exceeding Rs. 50,000/- in a single day. This measure is aimed

at encouraging tax compliance and expanding the tax base.

The tax provision covers cash withdrawals made

through credit cards or ATMs, ensuring that significant cash transactions are

subject to the withholding tax.

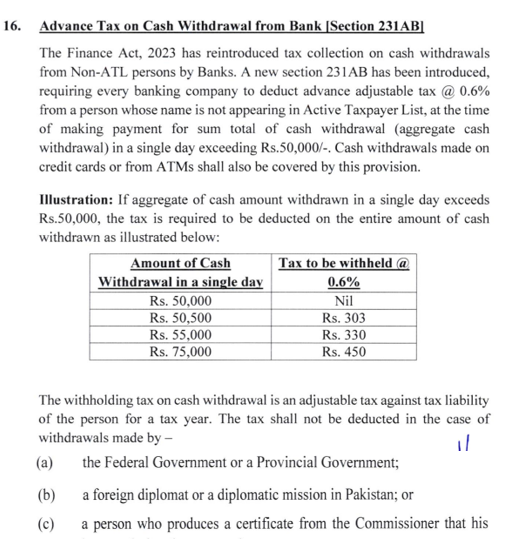

To understand how the tax is calculated, the FBR

provided the following examples:

1. Cash withdrawal of Rs. 50,000 or less in a single day: No tax deduction.

2. Cash withdrawal of Rs. 50,500 in a single day:

Tax deduction of Rs. 303.

3. Cash withdrawal of Rs. 55,000 in a single day:

Tax deduction of Rs. 330.

4. Cash withdrawal of Rs. 75,000 in a single day:

Tax deduction of Rs. 450.

It's important to note that the withholding tax on

cash withdrawals is considered an adjustable tax against the individual's tax

liability for a given tax year. This means that the deducted tax will be taken

into account while calculating the final tax payable for the year.

However, there are certain exemptions to this new rule. The tax will not be deducted in the case of cash withdrawals made by:

(a) The Federal Government or a Provincial

Government;

(b) Foreign diplomats or diplomatic missions in

Pakistan;

(c) Individuals who can provide a certificate from

the Commissioner stating that their income during the tax year is exempt.

Snapshot is as follows regarding Cash Withdrawal from Bank (portion)

Circular No. 2 of Income Tax, dated July 26, 2023

This move is part of the government's efforts to

increase tax revenue and reduce the tax gap by ensuring that all eligible

taxpayers fulfill their tax obligations. Additionally, it aims to promote a

more transparent and efficient tax collection process in the country.

.png)